REAL ESTATE

An expansive portfolio, calibrated for consistent growth

Our $7+ billion real estate portfolio* is designed to harness the macroeconomic drivers of the U.S. real estate market and position our clients for long-term growth.

Get Started

Our $7+ billion real estate portfolio* is designed to harness the macroeconomic drivers of the U.S. real estate market and position our clients for long-term growth.

Get Started

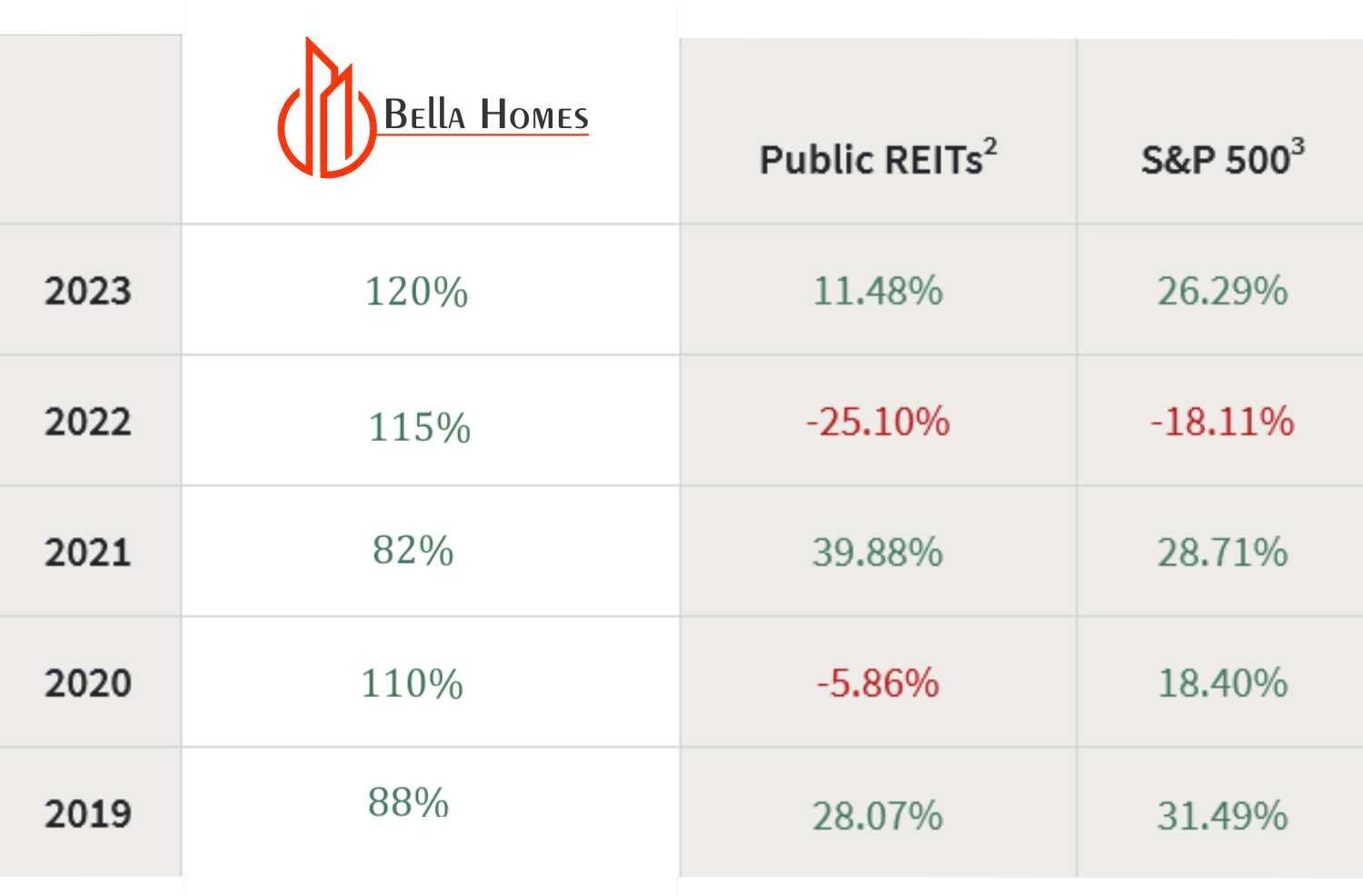

One of the most important questions that any investor should ask when evaluating a new investment advisor is “how have you performed for your existing clients so far?” With over 387,000 clients pursuing a wide range of objectives, the answer is more nuanced than a single number.